In an era where SaaS companies face increasing pressure to demonstrate sustainable growth, mastering Annual Recurring Revenue (ARR) forecasting has become critical for success. This comprehensive guide demystifies ARR calculation and forecasting, offering practical frameworks for both early-stage startups and established SaaS businesses.

In the dynamic world of SaaS, understanding your revenue streams isn't just important—it's essential for survival. While traditional businesses focus on one-time sales, SaaS companies thrive on the predictable, recurring revenue that powers innovation and sustainable growth. At the heart of this model lies Annual Recurring Revenue (ARR), your company's financial crystal ball.

But here's the reality: despite its importance, many SaaS leaders struggle to effectively forecast and leverage ARR for strategic decision-making. Let's change that.

Demystifying ARR: The Backbone of Your SaaS Business

Think of ARR as your company's yearly subscription power. It's the sum of all recurring revenue normalized on an annual basis, excluding one-time fees and variable charges. But why does it matter so much?

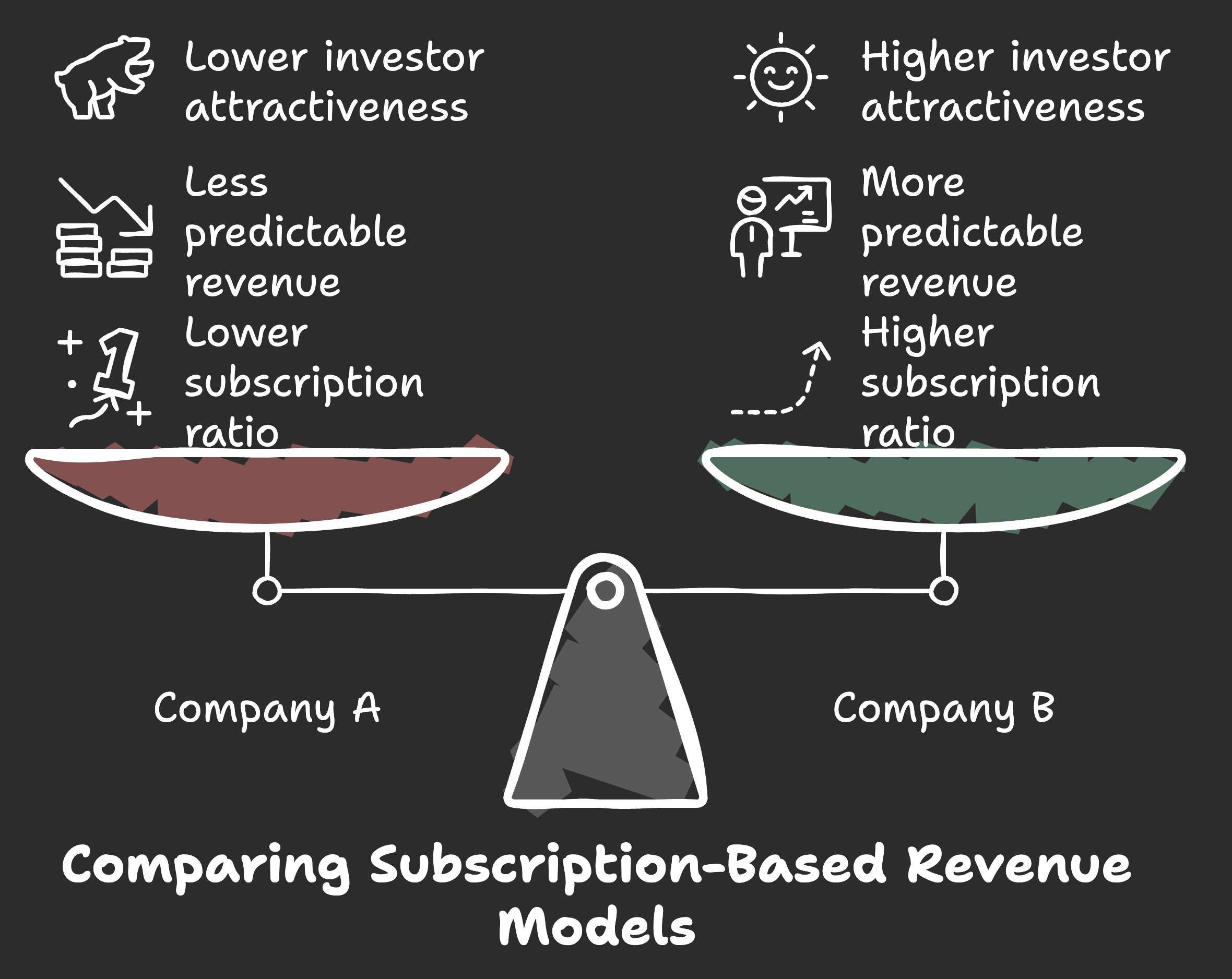

Consider this real-world scenario: Company A has $1M in total revenue, with 80% from recurring subscriptions and 20% from professional services. Company B also has $1M in revenue but with 95% from subscriptions. While their top-line numbers look identical, Company B's higher ARR suggests greater predictability and scalability—making it more attractive to investors and potentially more valuable.

The ARR vs. MRR Debate

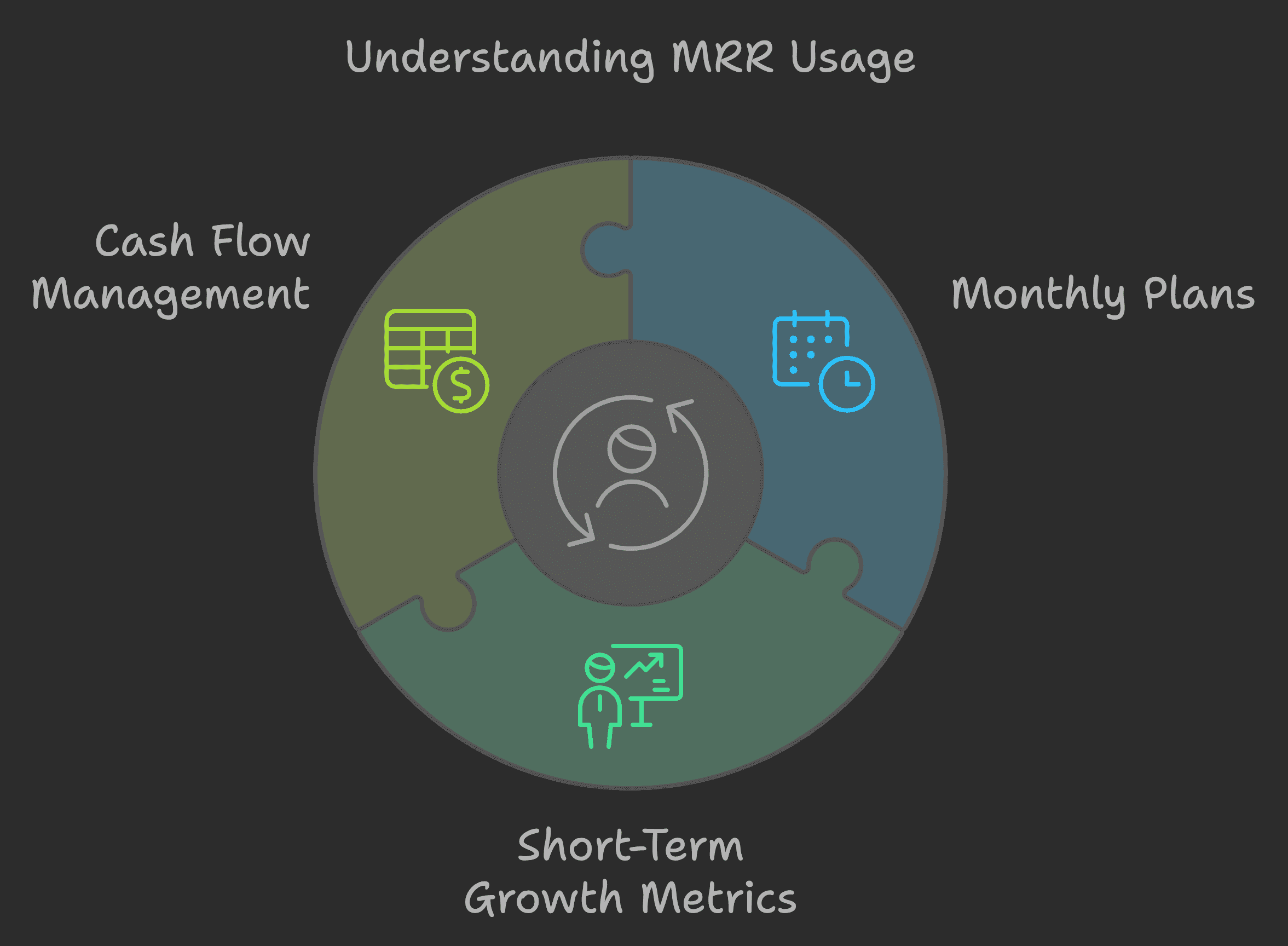

While Monthly Recurring Revenue (MRR) offers a granular view of your business, ARR provides a more strategic perspective, especially for companies with annual or multi-year contracts. Here's when to use each:

Use ARR when:

Your contracts are primarily annual or multi-year

You're planning long-term strategy

Speaking with investors or board members

Use MRR when:

Most customers are on monthly plans

Tracking short-term growth metrics

Managing cash flow

Mastering the Art of SaaS ARR Calculation

But the devil is in the details. Let's break down the components:

New Business ARR: Revenue from new customers

Expansion ARR: Additional revenue from existing customers

Churn ARR: Lost revenue from cancellations

Contraction ARR: Reduced revenue from downgrades

Consider this example:

Starting ARR: $1,000,000

New Business: +$300,000

Expansion: +$200,000

Churn: -$100,000

Contraction: -$50,000

Ending ARR: $1,350,000

Building a Robust SaaS Revenue Model

Revenue forecasting isn't about perfect predictions—it's about making informed decisions. Here's how to build a model that works:

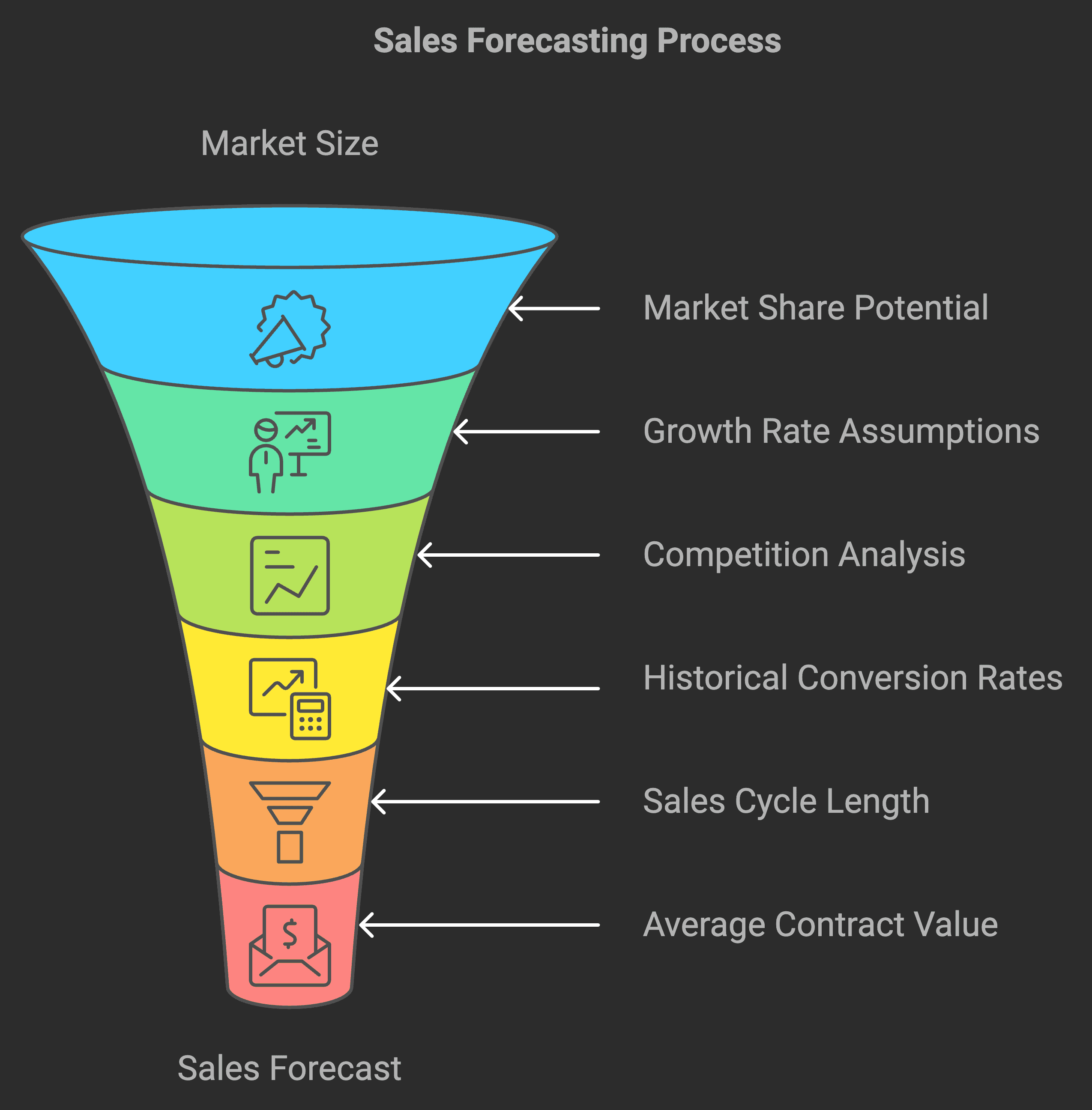

Bottom-Up Forecasting

Start with granular data:

Historical conversion rates

Sales cycle length

Average contract value

Churn rates

Expansion rates

Top-Down Forecasting

Begin with market size and work backward:

Total addressable market

Market share potential

Growth rate assumptions

Competition analysis

Pro Tip: Early-stage startups should focus on bottom-up forecasting, as it relies more on actual data than market assumptions.

Level Up Your Forecasting: Momentum ARR Tables

Momentum ARR tables are your secret weapon for sophisticated forecasting. Here's how to use them:

Create Monthly Snapshots

Starting ARR

New ARR

Expansion ARR

Churn ARR

Contraction ARR

Ending ARR

Analyze Trends

Growth rate consistency

Seasonal patterns

Churn clusters

Expansion opportunities

From ARR to GAAP Revenue: Bridging the Gap

Understanding the relationship between ARR and GAAP revenue is crucial for accurate financial reporting. Here's what you need to know:

Contracted vs. Deployed ARR

Contracted ARR (CARR): Revenue from signed contracts

Live ARR (LARR): Revenue from actively deployed services

The gap between CARR and LARR affects both cash flow and GAAP revenue recognition. For example, a $120K annual contract signed in December but deployed in January creates a timing difference between ARR and recognized revenue.

Best Practices for Revenue Recognition

Track implementation timelines

Monitor deployment milestones

Document revenue recognition policies

Maintain separate metrics for CARR and LARR

The Path Forward: Implementing Your ARR Strategy

Success with ARR forecasting requires more than just calculations—it demands a systematic approach:

Build Your Foundation

Choose appropriate metrics

Implement tracking systems

Establish regular review cycles

Refine Your Process

Test different forecasting methods

Document assumptions

Update models regularly

Drive Action

Share insights across teams

Set ARR-based goals

Create feedback loops

Remember: The goal isn't perfect predictions but better decisions. Start simple, iterate based on data, and gradually increase sophistication as your business grows.

Conclusion

Mastering SaaS ARR and revenue forecasting is an ongoing journey. By understanding the fundamentals, implementing the right tools, and continuously refining your approach, you'll gain the insights needed to drive sustainable growth.

Ready to take your ARR forecasting to the next level? Start by implementing one new technique from this guide and measuring its impact on your forecasting accuracy. Your future self will thank you.

Related Article