Nov 20, 2024

The Ultimate Guide to Annual Contract Value in 2025

Can Aslan

Annual Contract Value (ACV) stands as a critical metric for SaaS businesses, yet many leaders struggle to harness its full potential. This comprehensive guide demystifies ACV calculation, revealing why it matters more than vanity metrics for sustainable growth.

In the furious world of SaaS, data is king. But with countless metrics vying for your attention, it's easy to get lost in the numbers. One metric, however, reigns supreme when it comes to sustainable growth: Annual Contract Value (ACV).

Think of ACV as your company's vital sign – it goes beyond vanity metrics, providing a clear picture of your revenue engine and guiding strategic decision-making. Whether you're a seasoned SaaS founder or a rising sales leader, understanding and optimizing ACV can be the difference between steady growth and exponential success.

What is Annual Contract Value ?

In its simplest form, ACV represents the average annual revenue generated from each customer contract. It normalizes revenue over a year, providing a consistent view even with variable contract lengths and pricing models. This standardization is crucial in the SaaS world, where subscription terms and pricing structures can vary significantly.

But why does ACV matter so much? In the dynamic world of SaaS, relying solely on total revenue can be misleading. Consider this real-world example:

Two SaaS companies, both generating $1 million in annual revenue, might look identical on paper. However, Company A has 10 customers with an ACV of $100,000, while Company B has 1,000 customers with an ACV of $1,000. While their revenue might seem similar, Company A's higher ACV suggests stronger customer relationships, potentially lower operational costs, and different growth strategies.

Mastering the ACV Calculation

The beauty of ACV lies in its simplicity. The basic formula is:

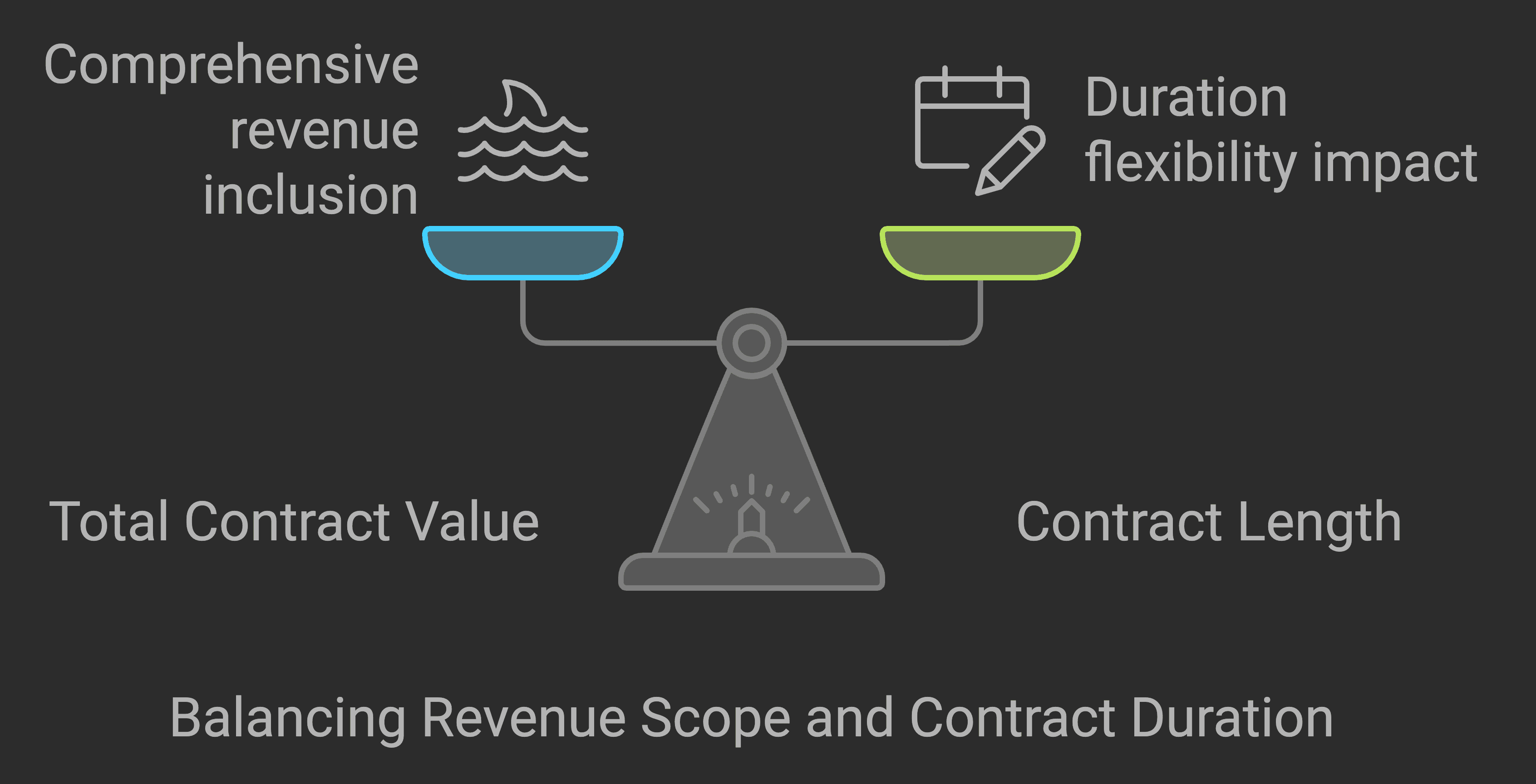

ACV = Total Contract Value (TCV) / Contract Length (in years)

Let's break down the components:

Total Contract Value (TCV): This includes all recurring revenue generated from the contract, excluding one-time fees

Contract Length: The actual duration of the contract, whether monthly, annual, or multi-year

For example, if a customer signs a 2-year contract for $5,000 per year, their ACV is $5,000. Simple, right?

However, real-world scenarios often include complexities like:

Discounts offered during contract negotiations

Upsells and cross-sells (tracked separately but important for customer lifetime value)

Variable pricing based on usage or features

Data-Driven Decisions for SaaS Growth

Understanding ACV is just the beginning. The real magic happens when you use this metric to drive strategic decisions:

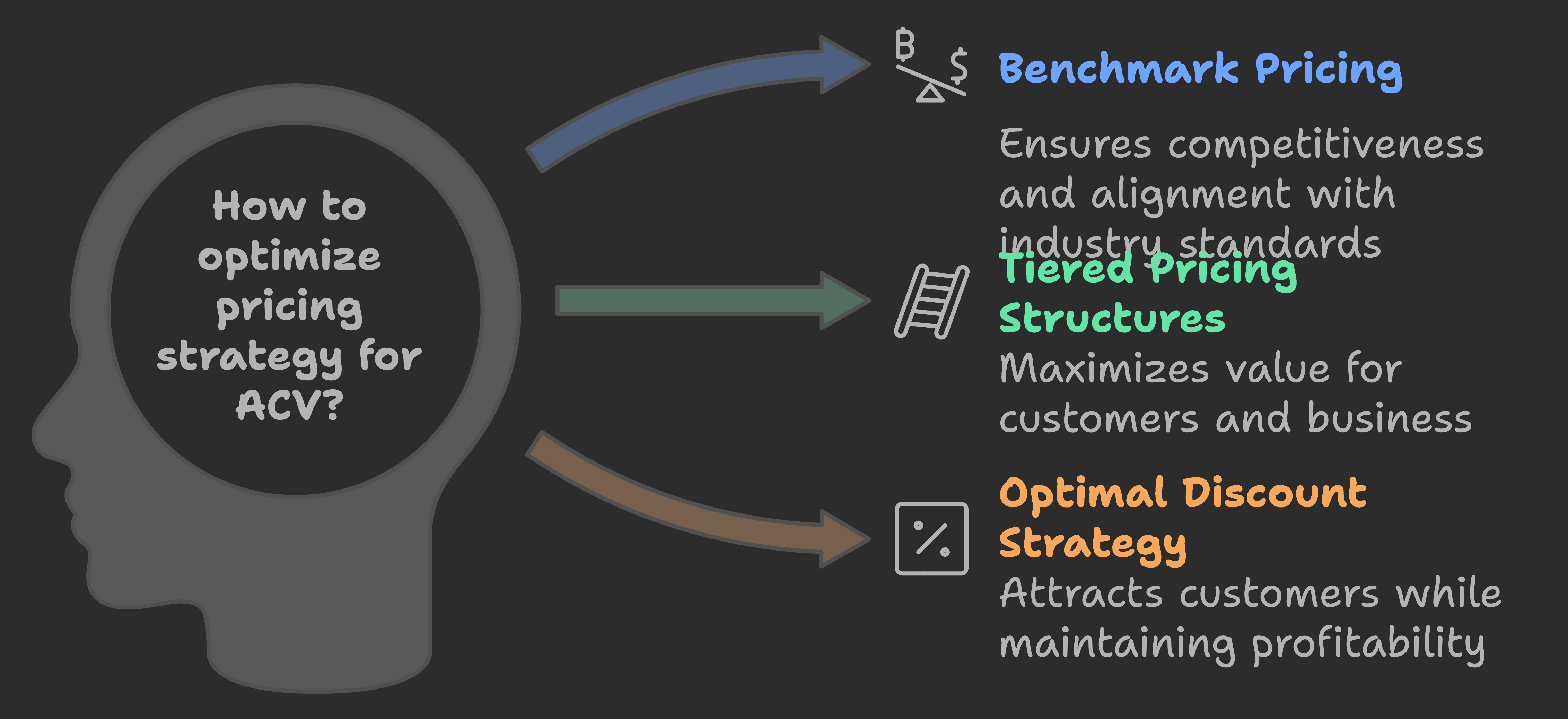

Strategic Pricing

Benchmark your pricing against competitors and industry standards

Design tiered pricing structures that maximize value for both customers and your business

Find the optimal discount sweet spot that attracts customers without sacrificing profitability

Sales & Marketing Alignment

Define and target your ideal customer profile based on ACV potential

Create personalized campaigns for high-value prospects

Implement Account-Based Marketing (ABM) strategies for high-ACV opportunities

Customer Success & Retention

Identify at-risk customers through ACV trends

Implement proactive engagement strategies for low-ACV customers

Design upsell pathways to increase customer lifetime value

Metrics That Complement ACV

While ACV is powerful, it works best as part of a broader metrics ecosystem:

ACV vs. ARR

Annual Recurring Revenue (ARR) shows your total recurring revenue normalized over a year. While ARR gives you the big picture, ACV helps you understand individual customer relationships.

Customer Lifetime Value (CLTV)

ACV forms the foundation for calculating CLTV, helping you predict the total value each customer brings to your business over time.

Customer Acquisition Cost (CAC)

Balance your ACV against CAC to ensure profitable growth. A healthy LTV:CAC ratio typically starts at 3:1 or higher.

Actionable Tips for SaaS Leaders

Ready to optimize your ACV? Here's your action plan:

Invest in a Robust CRM: Track customer data, contract values, and renewal dates systematically

Automate Reporting: Build dashboards that track ACV trends and identify opportunities in real-time

Empower Your Team: Align sales, marketing, and customer success around ACV goals

Embrace Experimentation: Continuously test and refine your pricing and packaging strategies

The Path Forward

Remember, metrics should guide your journey, not define it. Make ACV your north star, and watch your SaaS business reach new heights. The question isn't whether to focus on ACV, but how quickly you can start optimizing it for growth.