If consolation payment hadn’t been for, working extra out of your regular work hours may be overwhelming, motivation absorbing, and even affect your social life with your overall health negatively. In such circumstances, extra payments are on the table such as double time which employers give their staff as a kind of consolation and thanks.

Although double time wages are not valid everywhere, overtime pay is given at the normal rate of one and a half in all conditions to pay regard to labor standards. To understand what double time pay is, you should also get informed about overtime pay and time and a half. Here is everything you need to know about double time - hours, OT, pay, laws, and more.

In situations like this, by understanding double pay and how to calculate it, you can ensure that you are financially rewarded for your time, work, and doing more than you should be.

Also, by tracking your time and budget simultaneously, you can keep yourself motivated and affect your output positively while saving your time by finishing your work orderly. You know the drill!

Let’s dip into it!

What is Double Time Work Pay?

Double time, -sometimes known as “double overtime”- is a rate of hourly pay corresponding to twofold of an employee’s basic pay in extreme or unusual circumstances that you need to work on. For example, federal holidays, overnight shifts, weekends, or an excessive amount of overtime.

It can be said that double-time payment is a way of compensation from employers to employees who work overtime for undesirable shifts. It is usually applied when you are already in overtime or sometimes to fill undesired shifts as mentioned above. It is up to your employer to pay you double time wages and choose which days to be open and closed for business.

So, you may work on holidays but be paid nothing more than your regular pay and it is not against the law.

Unlocking the Mystery of Overtime and Time and a Half Pay

Overtime is hours employees work extra than their bounden duty. According to the Fair Labor Standards Act (FLSA), “the pay rate required for overtime is minimum of 1.5 times the regular hourly rate for all hourly workers in the US after exceeding 40 hours of work in a workweek.”

This rate of payment is called time and a half. Employers must pay time and a half, but they can choose to pay double time depending on their own pay policies to remunerate their employees.

What's the difference between overtime and double time?

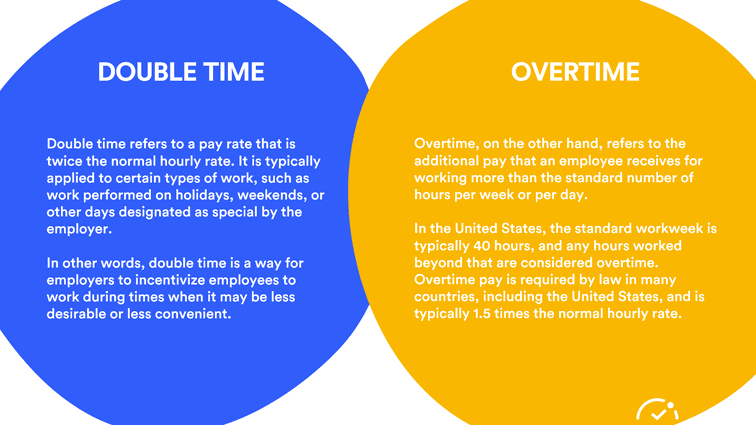

Both overtime and double-time pay schemes reward workers with financial compensation if they put in time beyond their scheduled shifts. The salary ranges represent the primary distinction between them.

The standard formula for calculating overtime compensation is 1.5 times the employee's base hourly wage. Therefore, if an employee's base salary is $10 per hour, their overtime compensation would be $15 per hour.

Alternatively, if an employee is eligible for double time pay, he or she will be compensated at twice the normal hourly rate. Applying the same logic, if an employee's standard hourly wage is $10, their double time rate would be $20.

Double time compensation is more than overtime pay, thus it's often used as an incentive by companies to get workers to put in extra hours outside of regular business hours (such on the weekend or a holiday).

When and Where Is Double Overtime Required?

Double time pay is not applied by law in the US for hourly workers except in California because the Fair Labor Standards Act (FLSA) does not cover it. Therefore, employers are not required to pay their employees double-time rate outside of California unless they have union agreements that require it; but must necessarily pay “time and a half” for overtime work pay standing for exceeding 40 hours of work in a workweek according to the law.

Double the Pay, Double the Fun: California's Unique Double Time Law

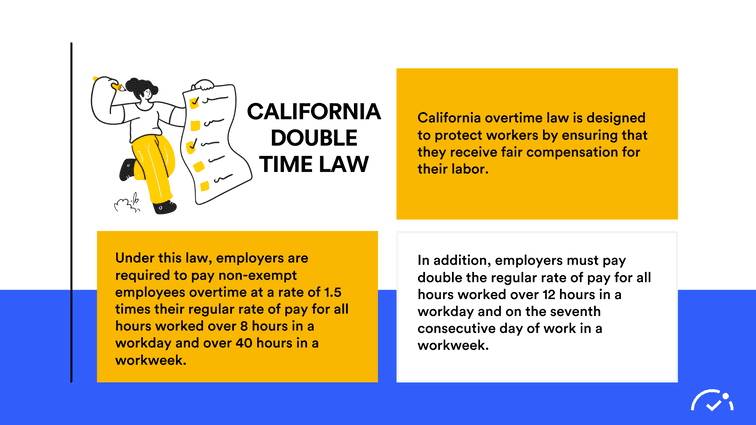

According to federal pay laws outside California, double time is not required but up to companies’ and employers’ own policies and will for employees who work overtime. In California, a day's work consists of 8 hours of labor and a week’s work consists of 6 days.

Special California Rules: Paid Double Time

According to State of California Department of Industrial Relations “Employment beyond eight hours in any workday or more than six days in any workweek requires the employee to be compensated for the overtime at not less than:

One and one-half times the employee's regular rate of pay for all hours worked in excess of eight hours up to and including 12 hours in any workday, and for the first eight hours worked on the seventh consecutive day of work in a workweek; and

Double the employee's regular rate of pay for all hours worked in excess of 12 hours (after that eight hours) in any workday and for all hours worked in excess of eight on the seventh consecutive day of work in a workweek.”

Do California overtime laws let exempt employees earn double-time pay?

Employees who are not entitled to overtime pay are not compensated in the state of California. A non-exempt worker must receive 1.5 times their regular rate of pay if they work more than 8 hours per day or 40 hours per week. However, individuals who work more than 12 hours each day ought to receive double the pay.

Do Companies Have to Offer Time & a Half for Overtime?

Nonexempt workers in the United States are entitled to be paid double their regular rate for any extra hours performed. In accordance with the Federal Fair Labor Standards Act, the government of the United States established the following regulation: (FLSA).

Under the Fair Labor Standards Act, workers must be compensated at a rate of 1.5 times their regular wage for each hour worked in excess of 40 in any given week (FLSA). Businesses are obligated to follow the law that gives workers the most benefits when various laws apply, such as California's overtime regulations.

Paid Double Time is a Choice Outside of California

Apart from federal law or outside of California, double time wages is a choice that employers can choose to remunerate their employees in exchange for doing their business. Double pay could be paid even if is not mandatory by order of the employer or not and it is not against the law unless companies have their own union agreements that require double pay.

In this way, even if double time is not eligible legally in their state, employers can decide their own company policies about overtime payments.

Know Your Rights About Overtime and Double Time

You need to examine your union contract or employee handbook to learn more about your company’s policy regarding overtime payments to receive accurately deserved payroll. You must find out if your company pays double time for overtime, hours worked on holidays, weekends, or other specific events.

On holidays including New Year’s Day, Martin Luther King, Jr. Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day companies may pay double time for hours worked, but again it depends on employers’ specific policies, so you need to know your rights delicately.

Hereby, you can calculate your eligible worked hours feasible for double-time payment and get your due!

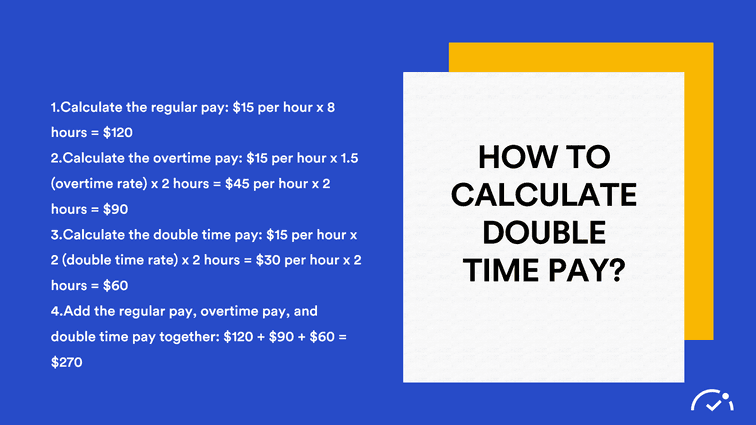

How to Calculate Double-Time Pay

Double-time pay is a type of remuneration that pays workers twice their standard hourly rate for work completed outside of regular business hours. Employers frequently offer double time pay as an incentive to workers who put in extra hours or work on holidays.

Both employers and workers must be aware of how to compute double-time pay to guarantee that the extra hours worked are fairly compensated. This article will outline the processes necessary to compute double-time compensation and include examples to make the procedure more understandable.

This section will provide you the knowledge you need to effectively calculate double-time compensation, whether you're an employer trying to establish a fair and open overtime pay policy or an employee trying to comprehend your rights and entitlements.

Double Time for Hourly Workers

To calculate double-time pay for hourly workers, you need to consider your normal hourly wage and duplicate it.

To calculate overtime pay, you need to add one and a half times your regular wage rate to the original amount.

To calculate double time wages, you need to find your normal hourly wage and duplicate it.

If you are an hourly worker, calculating double time hours is easy with basic math.

For instance: if you earn $17 hourly, you will get $34 hourly with double time.

Double Time on A Salary

For salaried workers a few more steps of calculation are required, do not worry; let’s take a look together:

·Multiply your monthly payment by 12 to get the annual salary.

·Divide the annual salary by 52 to get the weekly salary.

·Divide the weekly salary by the number of legal maximum regular hours (40) to get the normal rate and double it!

For instance: If you paid $4000 monthly, you would get a $48.000 annual salary. By dividing it by 52 you figure out that your weekly salary is approximately $923. Finally dividing it by the number of legal maximum regular hours (40), you come to the conclusion that your regular wage rate is approximately $23 and double time is $46.

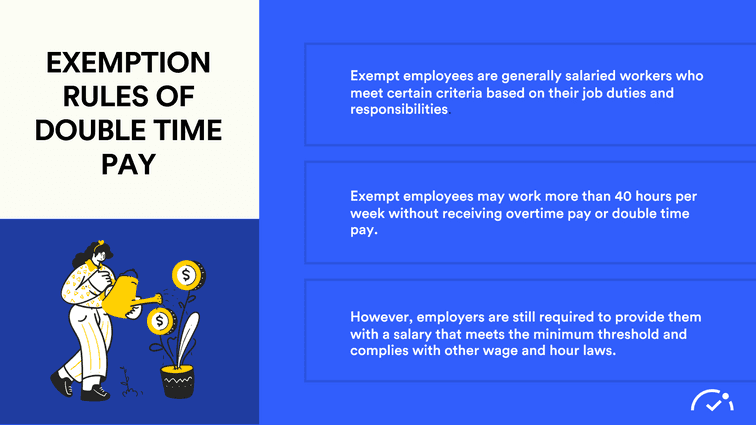

Exemption Rules of Double Time Pay

The laws governing double time pay compensation and exempt employees differ based on the jurisdiction. As they are regarded as salaried and are exempt from the overtime requirements of the Fair Labor Standards Act (FLSA) or comparable state law, exempt employees are often not entitled to overtime compensation or double-time pay.

The precise standards for determining exempt status, however, might differ by jurisdiction and can be dependent on elements including the employee's work responsibilities, pay grade, and salary basis. In some areas, some exempt employees may still be entitled to double compensation for hours worked beyond a predetermined threshold for a workday or workweek.

In order to make sure they are in compliance with the relevant laws and regulations and properly compensating their employees for all hours worked, employers must understand the specific laws and regulations in their jurisdiction as well as the classification of their employees as exempt or non-exempt.

What is the difference between an exempt and a non-exempt worker?

A worker's eligibility for overtime compensation under the Fair Labor Standards Act (FLSA) or an analogous state statute distinguishes them from non-exempt employees.

The FLSA's overtime rules do not apply to exempt employees, thus they are not entitled to extra compensation for hours worked in excess of 40 in a workweek. Executive, administrative, professional, outside sales, and computer personnel are examples of exempt employees that normally get a salary and perform work that falls under one of these categories.

Take into account that, non-exempt employees qualify for overtime compensation at a rate of 1.5 times or twice their normal rate of pay for any hours beyond 40 worked in a workweek. Non-exempt employees often work hourly jobs that do not fall under one of the aforementioned exempt categories.

Employers must appropriately categorize their staff as exempt or non-exempt, and they must pay non-exempt staff for all hours worked, including overtime. Employees who are incorrectly labeled as exempt when they are in fact non-exempt may be subject to legal repercussions, fines, and back pay.

Am I entitled to overtime pay if my boss did not request the extra work?

If your manager did not request the extra work, but you were forced to complete it as a condition of your employment, then you are still entitled to overtime compensation. No of whether your manager directly requested the extra work or not, you are entitled to overtime compensation under the Fair Labor Standards Act (FLSA) or analogous state legislation for any hours above 40 in a workweek.

Employers must fairly compensate their workers for how many hours worked; they cannot get out of paying overtime by simply refusing to ask for the job to be done. If you are a non-exempt worker who worked more than 40 hours in a workweek, you should be compensated for those extra hours with overtime pay at a rate of 1.5 times your usual rate of pay.

If you think you should have gotten overtime compensation but haven't, you might want to talk to your employer about it or get help from an experienced labor and employment lawyer.

Ensuring Compliance with Overtime Pay Requirements

Understanding and applying overtime pay requirements is crucial for staying in compliance with labor laws. Employees earn their regular pay rate during a single workday, but once overtime hours begin, the overtime wage kicks in. Typically, this means time and a half, but in some cases, like in California, employees are entitled to double time for extensive hours within a single workweek.

Calculating double time involves doubling the regular pay rate and applying it to the qualifying hours. This ensures you meet federal labor laws and all legal requirements related to employee compensation. Properly managing overtime hours and overtime wages not only maintains compliance with labor laws but also helps preserve employee motivation.

FAQ About Double Time Pay

What is full-time?

When someone works a "full-time" job, they put in the number of hours per week that are customary or typical for their organization and industry. A full-time workweek generally consists of 35 to 40 hours of labor, however, this varies by organization and industry.

Some of the benefits that a full-time employee frequently receives but part-timers do not include are health insurance, vacation time, retirement plans, and other forms of compensation. Additionally, they could have set working hours and a predictable salary.

It's crucial to remember that certain businesses may see employees who work less than 30 hours per week as full-time employee, whilst other businesses may need employees to work more than 40 hours per week in order to meet the definition of full-time. Furthermore, local rules and regulations may affect what is considered "full-time" work.

What is part-time?

When compared to full-time job, part-time work entails less hours each week for the employee. Part-time employment is defined by a weekly work schedule of fewer than 35 to 40 hours.

Part-time workers may have either a regular schedule or a more fluid one that changes from week to week. They may be entitled to some benefits like prorated paid time off or retirement plans, but they may not be as generous as those given to full-time employees. The income of a part-time worker is typically less stable than that of a full-time worker since they are paid an hourly rate rather than a salary.

Employers and workers alike may reap the rewards of a part-time work schedule. Part-time workers benefit from lower labor expenses for their employers and more manageable schedules for themselves. Students, people with family or caregiving duties, and those trying to supplement their income may all benefit from part-time employment.

What are double time pay holidays?

Double time pay holidays refer to specific holidays when employers pay their employees at a rate that is twice their regular hourly pay. Typically, these holidays are recognized as important days on which most businesses are closed or operate at reduced hours.

The specific federal holidays that are considered double time pay holidays can vary depending on the employer, industry, and location. In the United States, the most common double time pay holidays include:

New Year's Day

Memorial Day

Independence Day

Labor Day

Thanksgiving Day

Christmas Day

On these holidays, employers may offer their employees double time pay as an incentive to work on a day when many businesses are closed. The specific requirements for double time pay on holidays can vary depending on the employer and the employment contract or collective bargaining agreement in place. Some employers may offer double time pay only to certain employees, while others may require employees to work a minimum number of hours or meet other criteria to qualify for double time pay.

Is working double time worth it?

Depending on the circumstances and choices of each individual, working overtime may or may not be worthwhile. Double time pay gives a greater rate of compensation than normal time or overtime pay, making it an appealing alternative for workers wishing to boost their income. Working extra hours could be required to satisfy financial responsibilities, advance in your job, or pay for unforeseen costs.

However, working overtime has negatives as well, including possible harm to one's physical and mental health, greater weariness, and worse work-life balance. It's critical to balance the advantages of earning more money with the possible drawbacks of working longer hours.

Additionally, not all businesses might provide double time compensation or could have particular criteria that must be satisfied before workers can get double time pay. Some firms could provide incentives or vacation time as alternatives to working overtime that workers might find more appealing.

The choice to work more hours will ultimately be influenced by personal factors, such as financial requirements, job expectations, and preferences. It's critical for workers to weigh the possible advantages and disadvantages of working more hours and to be sure that doing so won't jeopardize their health and wellbeing.

Preserving Motivation, Time, and Money While Overworking

Last but not least, your social life with both your mental and physical health should be carefully treated while you are intensely working. Also demanding your fair share and going after the effort and time spent is a key to your motivation.

Working overtime could help you to make a profit for your overall output and financial gain thanks to overtime payments as double time but at the same time process management plays a significant role to overcome this paced process. Also demanding your fair share and going after the effort and time spent is key to your overall satisfaction.

Working overtime can be a burden, but if you know your rights and the laws surrounding double time, you can make sure you're being fairly compensated. Be sure to stay up-to-date on the latest information so you can get paid what you deserve.

Preserving your motivation, time and money are likely possible thanks to time management and your motivation would be boosted if you could observe your earnings alongside the time you spent working. Do yourself a favor and pick up the pieces in a breeze with our user friendly time tracking software!