Time and a half pay is something that most people don't know about. Many people do not understand how to get paid more for the hours that they work. This article will let you in though. It will help you to understand how to get this great extra money. Remember that it might sound like a lot of money but it can still be worth it because you never know when you might need the extra cash.

What Is Time and a Half? And How to Calculate it?

Time and a half refer to an increased rate of hourly pay that all hourly workers in the US, unless exempt, must receive at the rate of one-and-a-half times their normal hourly wages. While being very easy to calculate for hourly workers, salaried workers may find time and a half somewhat difficult to calculate.

In simpler terms, it means that if you have worked overtime for a certain number of hours or exceeded the 40-hour workweek, your hourly pay for the extra hours you have worked will be one-and-a-half times your standard hourly rate.

So, an employee who works with a standard rate of $20 per hour will receive $30 (hour and a half) for each hour that exceeds their usual hours, or 40 hours.

You might also like:

- What Is Paid Time Off (PTO) And How Is It Calculated?

- 25-Minute Timer Technique - How It Can Skyrocket Your Productivity

- Areas of Improvement at Work

Companies usually pay it to incentivize workers to work during holidays, weekends, or at other times when they may not wish to do so. And depending on the company’s overtime policy, certain days, such as religious holidays, may be eligible for double-time rather than time and a half.

Overtime pay policies may differ according to the specific company. Still, in almost all cases, hourly workers in the US will either receive double pay per every extra hour worked, known as double time or will be paid based on time-and-a-half.

Overtime Pay Rules for Holidays

However, there is no added clause in the FLSA for weekends and holidays. This means that employees over the age of 16 do not necessarily have to receive overtime pay for working on weekends, holidays, or their usual rest days unless they work overtime. But it must also be added that it is a well-established standard for most companies in the US to pay overtime on these days.

What Holidays Do you get Paid Time and a Half? (Federal Holidays etc.)

Time and a half pay can change according to the country, holidays, and whether or not their job makes them exempt from time and a half pay. Firstly the limit to be eligible for time and a half pay is 40 hours, If you worked more than 40 hours this week you can find out your company's time and a half policies by asking your manager or looking in the employee handbook.

Oftentimes, companies give time and a half for federal holidays and Sundays. The most common holidays that qualify are New Year's Day, Martin Luther King Jr. Day, and Easter.

Exemption Rules for Time and a Half

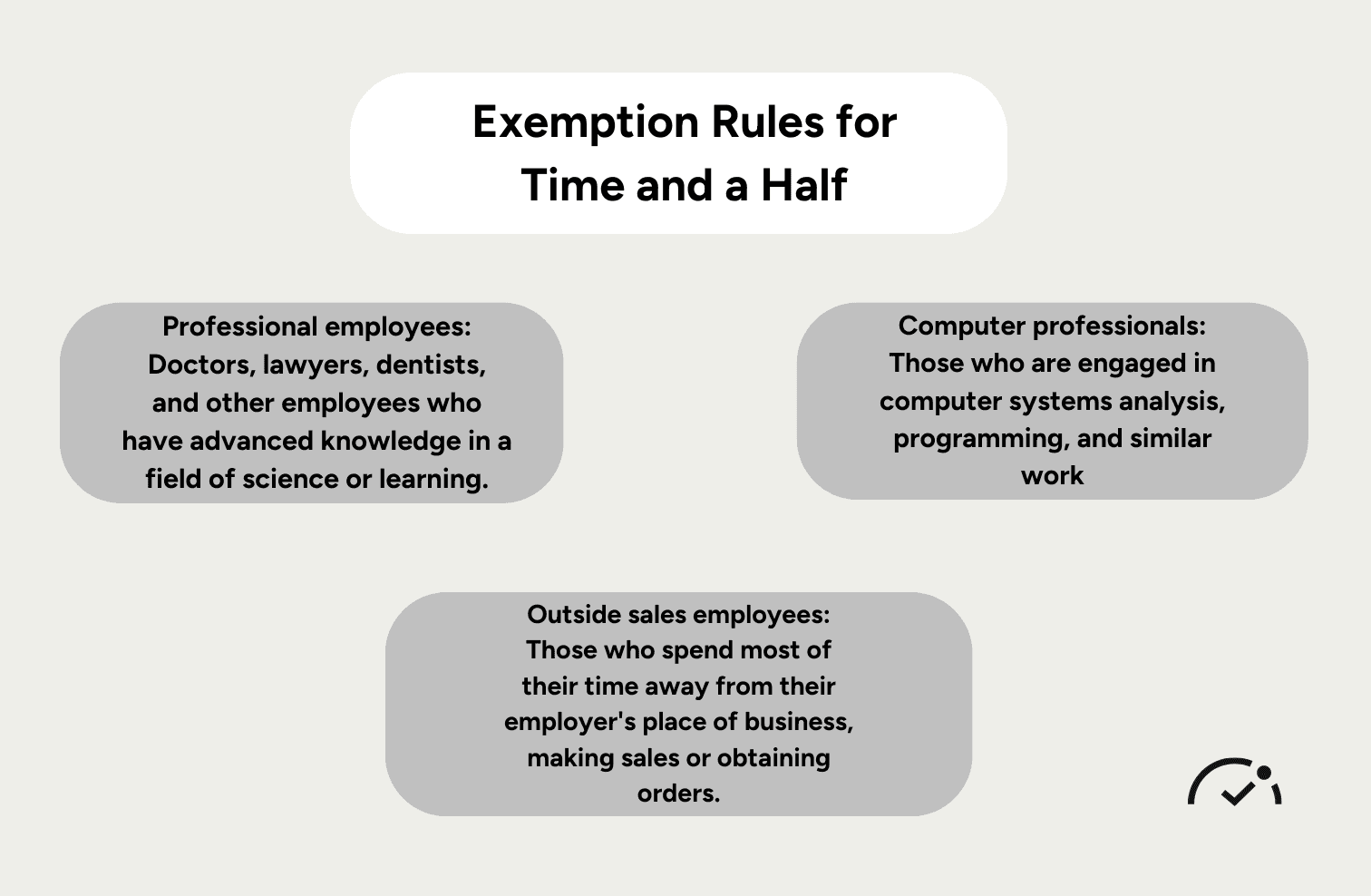

Certain types of employees are separated as exempt under the FLSA and, therefore, not entitled to overtime pay. For exempt employees, overtime pay will depend on their state’s additional labor standards laws and the company’s overtime payment policy.

This means that some employees exempt from overtime pay, as stated in FLSA, can still receive this, and more depending on which state the employee works in and their company’s preferences on overtime pay.

In addition, it must also be mentioned that regarding this, the practice seems to differ from the theory. You see, overtime pay as a concept has been a part of our work culture for a long time. And not only that, but as mentioned before, it is a great incentive for many employees. This has led many companies to support overtime pay even if their state does not force them to do so.

Sometimes, overtime pay may be included within the agreed-upon monthly salary, particularly for salaried workers. However, in that case, if the employee is consistently being asked to work overtime, they can use this to negotiate a raise.

An employee’s exemption status depends on various factors aside from those outlined in the FLSA. Again, most states have additional clauses on the exemption, and many workers, such as interns, workers-in-training, and foreign workers, are usually subject to different regulations.

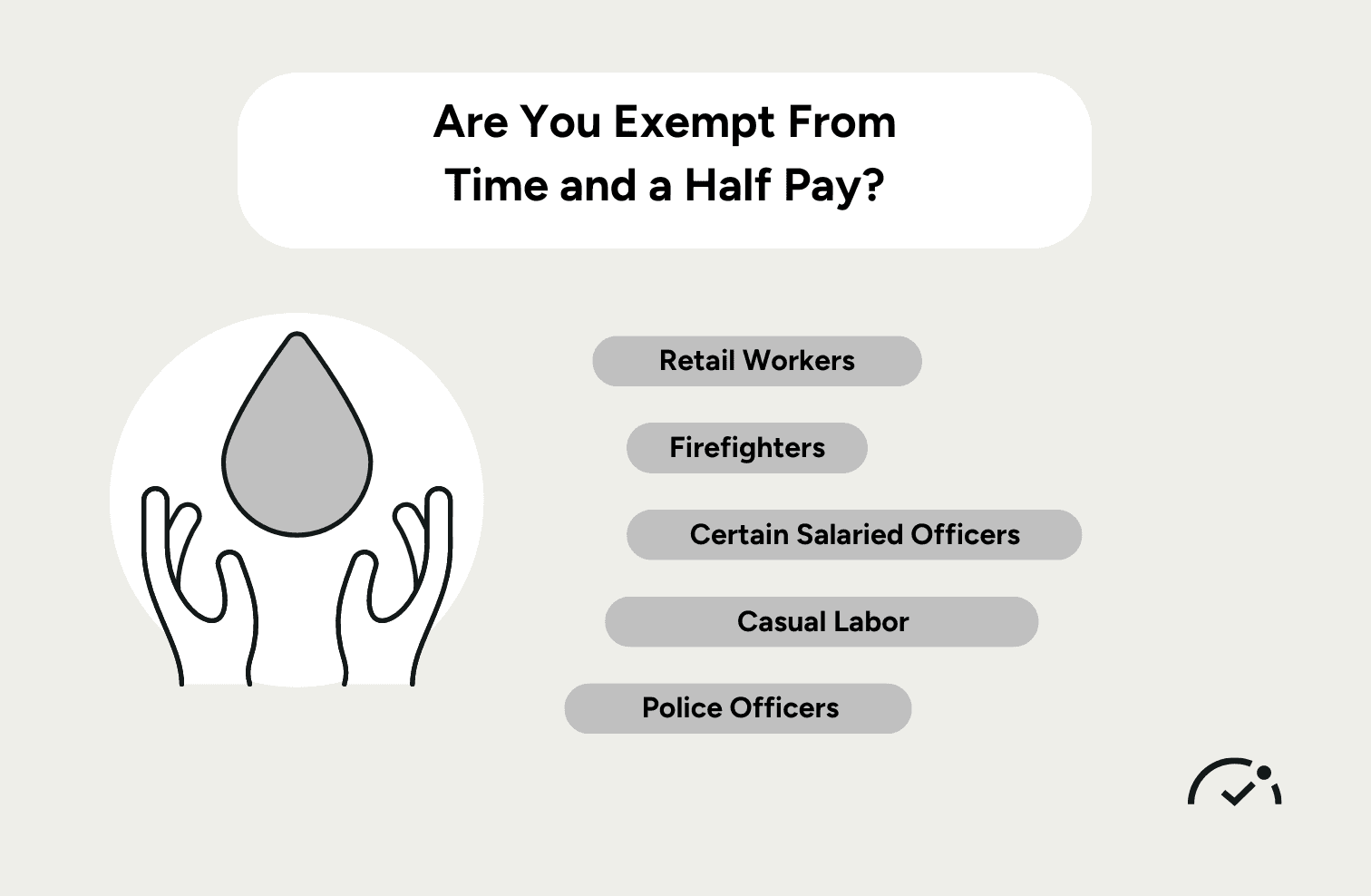

However, as a rule of thumb, employees are, in most cases, exempt from overtime pay if the following applies to their position:

They receive a monthly salary rather than payment based on working hours,

Their position entails high-level responsibilities which can directly affect the company’s overall operations (executive, administrative, or computer-based duties),

They make at least $35,568 per annum (or $684 per week).

Additionally, employees within the sales department whose primary responsibilities include making sales are also exempt from the FLSA.

How to Calculate Time and a Half with Paid Hours?

If you're paid hourly and not salaried, you've likely wondered how to calculate time and a half. You work more than 40 hours a week…but do you get paid for it? Do you have to work overtime to be eligible for premium pay? If you're like many other hourly workers in the United States, then your answer is "yes".

How Much Is Time and a Half?

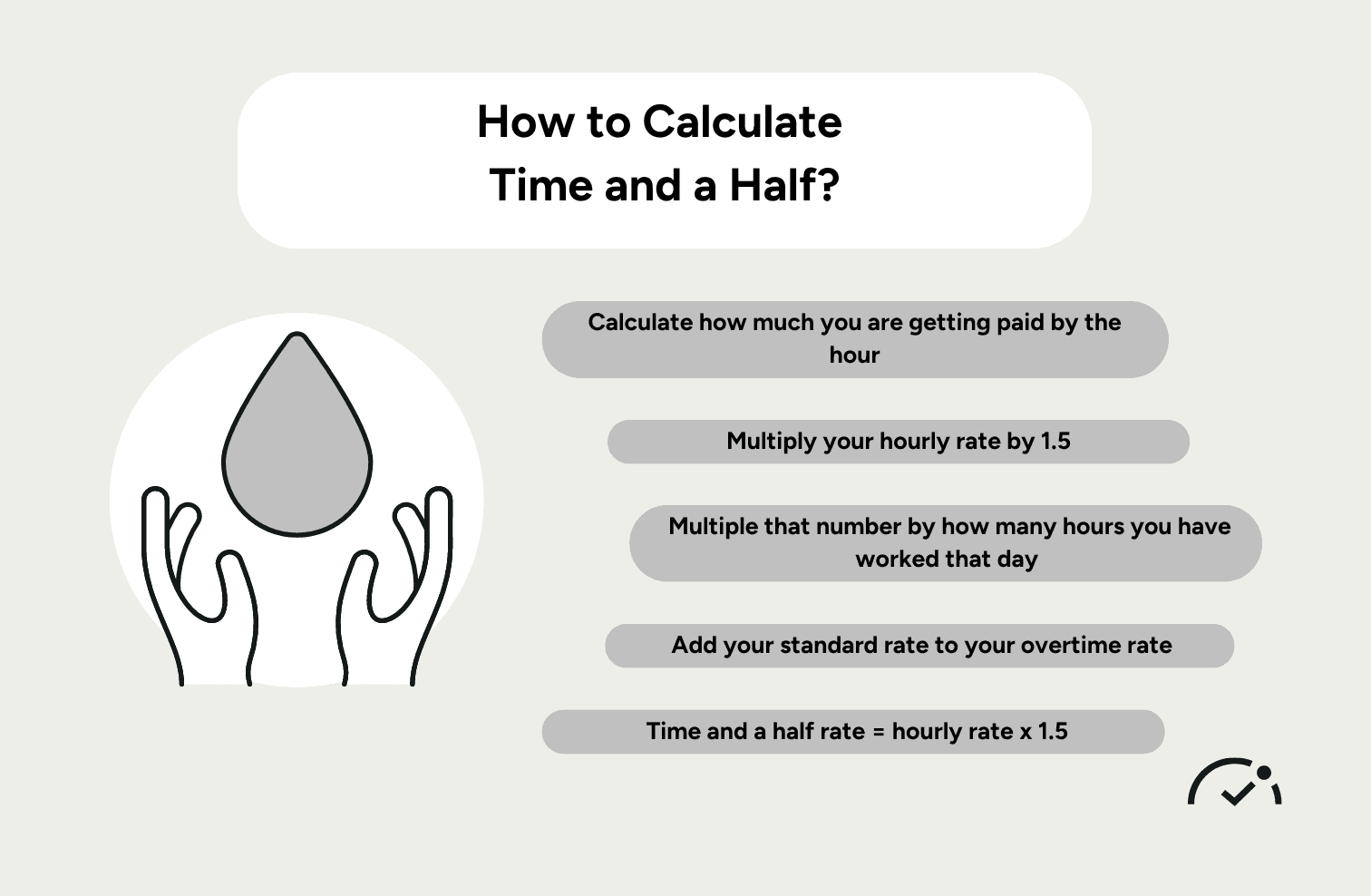

The equation to calculate time and a half rate is quite simple. Still, it must also be noted that when doing payroll calculations, there are different factors to consider for hourly employees and salaried employees.

Time-and-a-half rate = hourly rate x 1.5

Employee Overtime for Hourly Workers

For hourly workers, payrolls can be calculated with the following steps:

- Calculate how many extra hours a particular hourly worker has worked in that particular payment interval and multiply them by 1.5 times the standard rate.

- If there are also extra hours that are subject to double time, separate these and multiply them by twice the standard rate.

- Calculate the grand total of the number of hours the hourly worker has worked under the standard time agreement and multiply them by the regular rate.

- Add together the employee’s standard pay and overtime pay.

Employee Overtime for Salaried Workers - Based On Gross Pay

However, for non-exempt salaried workers, this process is a bit trickier. Like those in marketing and sales, many positions involve tasks in which measuring the usual working hours may be somewhat tricky. But for these types of workers, the following can be used to calculate time and a half pay:

- Calculate the employee’s standard hourly rate by dividing their salary by how many hours that employee typically works. Then, find the time and a half rate by multiplying the standard hourly rate by 1.5.

- For each overtime hour the employee has worked, multiply their hourly rate from the previous step by the number of extra hours.

How Much Overtime Is Too Much?

The quantity of overtime that is deemed "too much" might change based on a person's unique circumstances, the demands of the profession, and the law. While working longer hours may not bother some individuals, it may negatively impact others' health, happiness, and work-life balance.

Labor laws in many nations include restrictions on how many hours an employee may work in a workweek and may mandate that employers provide overtime compensation for hours exceeding a certain threshold. These restrictions are intended to safeguard employees from unreasonably high expectations and to encourage a positive work-life balance.

When assessing if overtime is excessive, keep the following criteria in mind:

Health and Well-Being: Working too much overtime might compromise one's physical and mental well-being by causing exhaustion, stress, and burnout. Keep an eye out for symptoms of fatigue, elevated stress, and declining health.

Productivity: Consistently putting in long hours at work may result in declining productivity gains. Extended work hours have been linked to lower productivity and a higher risk of mistakes, according to studies.

Work-Life Balance: For general happiness and fulfillment, maintaining a healthy work-life balance is essential. It may be an indication that overtime is too much if it often gets in the way of relationships, hobbies, or personal time.

Legal Limits: Recognize the rules and legislation pertaining to work in your nation or area. There are many companies that have weekly cap on the amount of hours an employee may work without getting paid overtime.

Demands of the Job: During periods of high demand, certain occupations or projects may necessitate periodic overtime. However, overtime could be deemed excessive if it turns into a recurring necessity and is not long-term viable.

- To calculate the employee’s total wages, add the overtime pay with the standard payment.

For payroll calculations, this process, especially for salaried workers, may be better calculated with an employee overtime calculator such as Omnicalculator and Quickhr Overtime Pay Calculator.

What Does Time And a Half Pay Rate Mean For $15?

Time and a half pay can be hard to understand at first therefore we want to explain it further by using an example. For instance, let’s say you get paid $15 per hour and you worked overtime. If you are not exempt from time and a half pay you can multiply your hourly wage by 1.5 and then write down your base hourly wage. In this case, If you worked overtime or worked on a holiday you get paid $22.50 per hour.

That means that you will be getting paid $7.50 more per hour. Working overtime can be a hassle but getting compensated for it can make it worth it.

What is $25 time and a half?

$25 time and a half is $37.50. This is calculated by multiplying $25 (the regular wage) by 1.5 (time and a half). $25 x 1.5 = $37.50

How much is time and a half for $12?

Time and a half for $12 is $18.00. How you calculate is by multiplying $12 (the regular wage) by 1.5 (time and a half). $12 x 1.5 = $18.00

What is time and a half for $20 an hour?

The time and a half overtime rate is $30 per hour for an employee whose regular hourly wage is $20.

To calculate this rate double the $20 standard pay rate by 1.5, which comes to $30.

So, for overtime hours, a worker earning $20 per hour would earn $30 per hour.

Time And a Half Calculator

If you want to calculate your time and a half quickly this chart could be helpful to you. All you have to do is to learn how much you are getting paid by the hour, your hourly wage multiplied by 1.5 gives you how much you will get paid by the hour when you are eligible for time and a half pay. Multiply the number you see on the chart by the hours you worked overtime or on a holiday. That is how much you will get paid at the end of the day.

How Do Bonuses and Commissions Affect Overtime Pay?

For employees subject to performance bonuses and commissions, these must also be factored in when calculating overtime pay.

For instance, when calculating the overtime pay rate of an employee whose standard hourly rate is $15 but also receives a performance bonus equivalent to $5 per hour, the time and a half rate for that employee in that particular period must be calculated with the total of standard hourly rate plus bonuses. So, for this employee, the time and a half rate would be 1.5($15 + $5) = $30.

You might also like our Time Card Calculator.

Employee Overtime Pay Rate

While on the subject of time. Working longer hours can positively affect your overall output, but did you know that it may also be very detrimental to your social life, productivity, and physical and mental health?

According to the World Health Organization, “Long working hours led to 745 000 deaths from stroke and ischemic heart disease in 2016, a 29 percent increase since 2000”. The numbers point to severe consequences of working long hours, a phenomenon that many of us may find ourselves facing.

But, In the modern workplace, many companies are beginning to shift towards encouraging employees not to sacrifice even more of their hours but to utilize productivity-boosting methods instead.

Because with the help of technologies like our AI-driven time management tool, you can successfully complete all of your tasks and still have time to devote to the more essential things in life. If you're constantly staying late at work to complete your tasks, time management can be a tool worth considering.

It will transform your work life. Another interesting area can be virtual offices, where you can then hold your meetings individually during your working hours. Because you have to remember, remote working will be the new future.

What determines overtime pay?

So who or what decides on overtime pay is the question. Federal, state, and any applicable collective bargaining agreements determine your overtime pay rate. Most non-exempt workers are entitled to 1.5 times their regular rate of compensation for any hours worked in excess of 40 in a workweek under the Fair Labor Standards Act (FLSA).

There are a few exceptions to this rule, such as the FLSA's exemption from overtime pay for domestic assistance and agricultural employment. Despite the fact that CEOs, administrative personnel, and professionals are compensated at this rate. Some states even have their own overtime compensation laws, with varying rates and threshold criteria.

Here is an important tip: some companies may be bound by collective bargaining agreements or employment contracts that set different overtime pay rates or who is eligible for overtime pay so always make sure to check that out.

How Do Time And a Half Benefit Employers?

Employers may feel like giving compensation to employees is a waste of money, but what they have to keep in mind is that this money returns to them as motivation. A motivated employee works harder to go above and beyond.

If your employees feel like they are valued and they are earning their worth they will try their best to keep that position. When you have fewer employees that want to quit it will save you money and time trying to find a replacement for them.

Also, they will be less likely to need to find a second job since one job is enough to support their living. It results in hard-working employees that are not distracted thinking about the second job they will go to after their current one.

How Does Time And a Half Benefit Employees?

Time and a half policy is giving compensation for the hard work employees do. They reward employees for working extra hours or unwanted shifts at the cost of a higher labor price tag for employers.

Time and a half is an incentive to encourage employees to work hard and commit to a long workweek. It is important to support your employees and make them feel valued which will increase their motivation and productivity.

Is overtime 1.5 or 2x?

A common question is whether overtime compensation is 1.5 times or 2 times the employee's regular pay rate. Well it depens on the rules and regulations of the specific location and the agreement with the employer.

The most common kind of overtime compensation in the United States is time and a half, which is 1.5 times the employee's usual pay rate for each hour of overtime work.

Some businesses, as an incentive, may pay double time, which is twice the employee's regular pay rate for each hour of overtime worked.

However, several countries have laws requiring double pay for overtime hours. It is critical to confirm the laws and legislation that apply in the specific location where the employee works.

What Are The 2 Different Types of Overtime?

Not many people are aware, but overtime has two distinct sides. They are these two kinds:

The most typical kind of overtime compensation is time and a half, which pays workers 1.5 times their usual hourly rate for every hour of overtime put in.

Even though double time overtime pay is less popular, certain firms may still give their staff members this perk. Each hour of extra work is compensated at double the standard hourly rate for the employee.

What is time and a half overtime rate?

Time and a half overtime rate refer to the pay rate that an employee receives for working overtime. That rate is designated as 1.5 times the employee's regular pay rate for each hour of overtime worked. To give an example to that, if an employee's regular pay rate is $20 per hour, their time and a half overtime rate would be $30 per hour ($20 x 1.5). This is a common pay rate for overtime in the United States.

How do you calculate 1.5 overtime?

Overtime is the extra hours done by an employee outside of their usual working hours or schedule. These extra hours are often compensated at a greater rate than regular hours to compensate for the employee's extra work and effort.

Overtime pay is typically required by law, and the rate at which overtime hours are reimbursed (such as time-and-a-half or double time) is sometimes regulated by legislation or by a collective bargaining agreement.

If you want to calculate 1.5 times overtime, you should first determine the regular hourly wage, and then multiply that by 1.5. To give an example to that if an employee earns $20 per hour as their regular wage, then their 1.5 times overtime rate would be $20 x 1.5 = $30 per hour. This means that for each hour of overtime worked, they would earn $30 instead of their regular wage of $20.

What does time and a half mean when it comes to your pay and when are you entitled to it?

"Time and a half" is a pay rate that is 1.5 times the usual hourly wage of an employee. If your usual hourly compensation is $15, then the time and a half rate would be $22.50 ($15 x 1.5).

When employees work overtime, they are usually entitled to time and a half pay, well in most cases that is. Overtime hours vary by jurisdiction, but in general, they are hours worked in excess of a particular amount of hours per week or per day.

Overtime pay is normally required in the United States for all hours worked in excess of 40 per week. Some states have various restrictions, and some businesses may have different agreements with their employees, so it's critical to research the exact laws and regulations in the state where you work.

Master Time and a Half Calculations: A Step-by-Step Guide for Home

In order to calculate time and a half compensation at home, you must first estimate your usual hourly wage. When you get that figure, multiply it by 1.5 to get your time and a half pay rate.

To give an example to that if you are a freelancer with a $30 hourly rate, multiply that by 1.5 to reach $45 as your time and a half hourly rate.

It is also very beneficial to keep a record of the hours worked so that you can precisely calculate the amount of extra compensation owed to you so try doing that.

How To Calculate Time And A Half Payments Under The FLSA?

The Fair Labor Standards Act (FLSA) defines time and a half as multiplying an employee's regular rate of compensation by 1.5. This may sound complicated but believe me it is very easy. The employee's total remuneration for the workweek, including base pay and any bonuses or commissions, is divided by the total number of hours worked during the same workweek to calculate the regular rate of pay.

Next up is to calculate time and a half compensation, first determine the employee's regular rate of pay. For example, if a person receives $15 per hour and works 40 hours per week, their regular hourly rate is $15.

The regular rate of pay would then be multiplied by 1.5 to determine the time and a half rate. In this case, $15 multiplied by 1.5 equals $22.50 per hour.

Finally, multiply the time and a half rate by the amount of hours worked during the normal workweek. For example, if an employee works 10 overtime hours, time and a half pay is calculated as $22.50 x 10 = $225.

It is crucial to remember that not all employees are entitled to overtime pay under the FLSA; for example, executive, administrative, and professional personnel are excluded from overtime pay if specific criteria are met. It's also worth noting that different states may have their own overtime requirements, so check with your state labor department for specific regulations.

What is the FLSA?

Now you might be wondering what it is so The Fair Labor Standards Act (FLSA) is a federal statute of the United States that was originally enacted in 1938. For full-time and part-time workers in the private sector as well as federal, state, and local governments, the FLSA mandates minimum wage, overtime pay, recordkeeping, and youth employment regulations.

Employers are required by the FLSA to pay covered employees a minimum wage of $7.25 per hour plus overtime pay of one and one-half times the employee's regular rate of pay for all hours worked in excess of 40 in a workweek. It also establishes rules for child labor and makes the hiring of children in certain jobs illegal.

The FLSA also requires employers to keep certain records for each non-exempt employee, including the employee's name, address, occupation, and daily and weekly hours worked.

The FLSA is administered and enforced by the Wage and Hour Division of the United States Department of Labor. Employers who violate the FLSA face back pay, damages, and civil penalties.

80/20 Rule

According to the 80/20 rule, a small fraction of employees (say, 20%) are responsible for a considerable share of a company's revenue or productivity (say, 80%). This interesting rule when it comes to wage rates, this could be the case. As a result, it is feasible that these "essential" individuals will be paid more than the remaining 80% of workers.

To exemplify this a company may use the 80/20 rule to identify which of its employees adds the most value to the company. As a result, the company may offer those employees higher pay, bonuses, or other incentives in order to keep them on board.

Salaried Employees With A Fixed Number Of Work Hours

When you are calculating overtime pay for salaried workers with a set number of hours, the number of overtime hours worked is often added to the employee's regular salary rate.

Then you divide the annual wage by the number of work hours in a year to get the regular hourly rate. To give an example to that, if an employee works 40 hours a week for 52 weeks a year, $40,000 divided by (40 hours x 52 weeks) = $20 per hour.

If you want to figure out the overtime rate for time and a half, you must multiply the regular hourly rate by 1.5, which is $30/hour. So to put it shortly, a salaried worker with a set number of hours would get $240 in overtime pay, which is $30 per hour times 8 hours.

Salaried Employees With A Fluctuating Workweek

Up next is the salaried employees with a fluctuating workweek, overtime pay is calculated differently than for salaried employees with a fixed number of work hours.

Under the fluctuating workweek method, the employee's regular salary is divided by the number of hours worked in that workweek, regardless of how many hours are worked. This results in a fluctuating regular rate of pay depending on the number of hours worked in a week.

Let's give an example, if an employee's salary is $40,000 per year, and in one week the employee works 50 hours, the regular hourly rate for that week would be $40,000 / 50 = $800/week or $16/hour. That means is that If the employee works 60 hours the following week, the regular hourly rate would be $40,000 / 60 = $666.67/week or $13.33/hour.

When it comes to calculating the overtime pay, you need to take one-half of the regular rate of pay for each overtime hour worked. So, if the employee works 10 hours of overtime in the first week, overtime pay would be $16/hour x 0.5 = $8/hour x 10 hours = $80. If the employee works 20 hours of overtime in the second week, overtime pay would be $13.33/hour x 0.5 = $6.67/hour x 20 hours = $133.40.

Demystifying Paid Time Off: A Guide for Employees and Employers

Paid time off (PTO) is a crucial aspect of any employee benefits package. However navigating the world of federal holidays, vacation time, compensatory time, and navigating these policies between federal and private employers can be confusing for both employees and employers. This blog post aims to clear up the confusion and provide a comprehensive guide to paid time off.

Federal vs. Private Employers:

Federal Employees: Federally mandated holidays are designated for all federal employees. These typically include ten paid holidays per year. Federal employees may also accrue vacation and sick leave, which can be used for various reasons, including personal time or illness.

Private Employers: Private employers are not obligated to follow federal holiday schedules, but many choose to do so, offering a similar number of paid holidays per year. Policies regarding vacation time, sick leave, and other forms of paid time off are determined by each individual employer and outlined within their benefits package.

Key Differences to Consider:

Vacation Time: This is typically a set amount of paid time off employees accrue over a year. It can be used for holidays, personal days, or vacations.

Holiday Time: These are specific days designated as paid holidays by the employer or mandated by the federal government (for federal employees).

Compensatory Time (Comp Time): This is time off earned by employees who work overtime hours at their normal rate of pay. It can be accrued and used later in lieu of overtime pay. Important Note: Comp time is not available to all employees, and eligibility depends on specific job classifications and employer policies.

Understanding "Normal Rate" vs. "Premium Rate":

Normal Rate: This refers to an employee's regular hourly or salary rate, used when calculating compensatory time.

Premium Rate: This is a higher rate of pay, typically time-and-a-half or double-time, paid for working overtime hours.

Legal Considerations:

Content Accuracy: It's crucial for both employers and employees to ensure a clear understanding of the benefits package and its specific details regarding paid time off. This includes the number of paid holidays, vacation time accrual, and comp time eligibility. Misunderstandings can lead to legal issues. Legal writers may be needed to ensure proper wording within employee handbooks to avoid confusion.

Legal Issues: Any disputes or misunderstandings regarding paid time off should be addressed through proper channels outlined in the employer's handbook or relevant labor laws.

Additional Tips:

Employees: Review your employer's benefits package thoroughly and understand the policies regarding paid time off, including accrual rates, deadlines for using vacation time, and procedures for requesting leave. As a business owner, you might also be an employee and subject to these policies, so understanding them is crucial.

Employers: Clearly communicate your paid time off policies to all employees. Ensure your employee handbook accurately reflects these policies and provides clear guidelines for requesting and using paid time off.

When negotiating an employment agreement, it's crucial to clarify provisions regarding legal holidays and vacation days, especially for full-time employees. Ensure that the agreement outlines the entitlement and procedure for taking vacation days, as well as any restrictions during peak business periods. Additionally, clearly define the company's policy regarding legal holidays and how they are observed. By addressing these aspects comprehensively in the employment agreement, both the employer and the employee can avoid misunderstandings and ensure a mutually beneficial working relationship.

Remember: Clear communication and a solid understanding of paid time off policies are essential for a positive work environment and a happy workforce.

BeforeSunset: A New Era in Time Management

BeforeSunset AI can boost productivity by assisting you in better understanding how you spend your time, identifying areas where you may be squandering time, and setting goals for how you want to use your time in the future. You can also uncover patterns in your work habits by recording your time, such as times of day when you are most productive or when you are easily distracted.

This data can then be utilized to design a more effective plan and set realistic targets for work completion. Tracking your time with BeforeSunset can also help you prioritize your chores and stay focused on the most critical ones.

So can we say that money is a productivity tool? If you want to up your productivity, even more, discover how much time you are spending at your work and what your budget is you can use BeforeSunset AI, a work management tool that will make the workday work for you.