Whether you're an HR professional, a manager, or a business owner, understanding FTEs is crucial for effective resource planning, budgeting, and staffing decisions. Our FTE Calculator simplifies the process, allowing you to effortlessly determine the equivalent number of full-time employees based on various work arrangements.

What Does FTE Mean 40%?

When FTE is followed by a percentage, such as "FTE 40%," it refers to a fraction of a full-time equivalent (FTE) position. In other words, it shows how many hours or how much labor an employee contributes in comparison to a full-time worker who puts in 100% of the required hours.

How to read "FTE 40%" is as follows:

A full-time employee who puts in the average 40 hours per week for that employment is represented by a full-time equivalent (FTE) of 100%.

"FTE 40%" denotes that the person is working 40 percent as many hours as a full-time employee. This implies that the person is either working part-time or giving to the company at a rate that is 40% lower than what a full-time employee would.

In terms of computation, a "FTE 40%" employee would be working around 16 hours per week (40% of 40 hours) assuming a full-time workweek is 40 hours.

This notation is frequently used to indicate a worker's workload as a percentage of a full-time position, making it simpler to compare the contributions of part-time and full-time workers.

What is 75% of FTE?

The term "75% of FTE" denotes a burden or job that is comparable to 75% of a full-time employee (FTE) employment. In other words, a worker who works at 75% of FTE is putting in 34 as much effort as a worker who works full-time.

You can use the procedures below to determine the number of hours or workload required to complete 75% of FTE:

Identify the typical full-time workday. Assume that there are 40 hours in a week.

Calculate the workload corresponding to 75% of full-time employment by multiplying the typical full-time work hours by 0.75, or 75% in decimal form.

Mathematically:

Workload for 75% of FTE is equal to 40 hours per week * 0.75 to 30 hours per week.

Therefore, if an individual is working at "75% of FTE," they are putting in around 30 hours per week, or 75% of a full-time employee's labor.

Full Time Equivalent Formula (FTE)

The Full-Time Equivalent (FTE) formula is used to calculate the equivalent number of full-time employees based on the combined work hours of part-time employees or employees working less than the standard full-time hours. The formula is straightforward:

FTE = (Total Work Hours of Part-Time Employees) / (Standard Full-Time Work Hours)

Why Calculate Your Full-Time Equivalent?

Full-Time Equivalent (FTE) calculation is crucial for a number of reasons, especially in business and labor management. The following are some main explanations for why businesses compute FTE:

Resource Allocation and Planning: By determining the total worker capacity, FTE calculations assist businesses in allocating resources effectively. This data is essential for assessing the organization's staffing levels in relation to its operating requirements.

Budgeting: FTE estimates help in planning a budget for wages, insurance, and other labor-related costs. Organizations can correctly estimate labor expenditures and manage cash by understanding the number of FTEs.

Staffing Levels: FTE calculations assist in determining the proper staffing level required to finish activities, projects, or provide services. By avoiding either overstaffing or understaffing, this guarantees maximum output.

Comparing Part-Time and Full-Time Contributions: FTE allows organizations to compare the contributions of part-time and full-time employees on a standardized basis. This is valuable for evaluating the efficiency and effectiveness of different staffing arrangements.

Workforce Analytics: FTE data offers insights into long-term workforce patterns that are helpful in strategic planning, hiring, and staffing choices.

Compliance and Reporting: In some sectors, laws or collective bargaining agreements may call for the reporting of FTE totals. Organizations can adhere to these regulations by using accurate FTE figures.

Project Management: FTE calculations are helpful in project planning because they enable project managers to determine the approximate number of workers needed for certain projects or initiatives.

Workload Allocation: FTE calculations assist in allocating workloads fairly among workers, minimizing burnout and promoting a healthy work-life balance.

Contractual Obligations: Companies that perform services under agreements may need to monitor FTE to make sure they meet their duties, particularly if precise FTE levels are specified in the contracts.

Making Strategic Decisions: Information about FTEs is useful for making decisions about hiring more people, cutting back on staff, outsourcing work, or making other organizational changes.

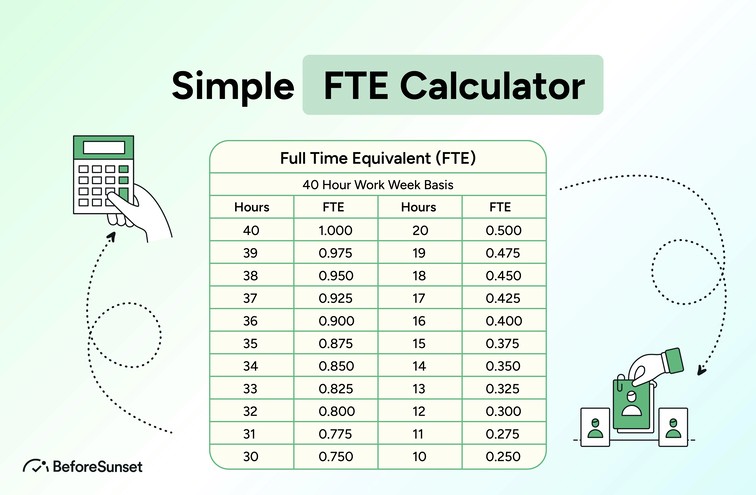

Full Time Equivalent Chart: 40-Hour Work Week

A Full-Time Equivalent (FTE) chart for a 40-hour work week showcases how different percentages of FTE correspond to the number of hours worked per week. Here's a sample chart that illustrates this relationship:

FTE Percentage

Hours Worked per Week

100% (1.0 FTE)

40 hours

75% (0.75 FTE)

30 hours

50% (0.5 FTE)

20 hours

25% (0.25 FTE)

10 hours

In this chart, the FTE percentages represent the proportion of a full-time workweek (40 hours). For example, at 75% FTE, an employee would work 30 hours per week, which is 75% of the standard 40-hour workweek.

You can use this chart to quickly reference how many hours an employee would work based on their FTE percentage. This is particularly useful for workforce planning, budgeting, and scheduling purposes.

Calculating Employee Cost

Calculating employee costs involves considering various expenses associated with employing individuals within an organization. Employee costs go beyond just salaries or wages and can include benefits, taxes, and other related expenses. Here's a breakdown of how to calculate employee costs:

Base Salary or Wage: Start with the employee's base salary or wage. This is the amount you pay the employee before accounting for any deductions or additional expenses.

Benefits:

Health Insurance: Calculate the cost of providing health insurance coverage for the employee. This can vary based on the type of coverage and the contributions made by both the employee and the employer.

Retirement Plans: Include contributions to retirement plans like 401(k) or pension plans. This can be a fixed percentage of the employee's salary or a specific amount.

Paid Time Off (PTO): Factor in paid vacation days, sick leave, and other paid time off. Calculate the cost of these days based on the employee's daily rate.

Other Benefits: Consider other benefits such as dental insurance, life insurance, disability insurance, and more.

Taxes:

Federal and State Income Tax: Calculate the amount of income tax to be withheld based on the employee's tax bracket and the applicable tax laws.

Social Security and Medicare (FICA) Taxes: Calculate the employee's contribution to Social Security and Medicare based on the appropriate tax rates.

Unemployment Insurance: Factor in unemployment insurance taxes paid by the employer.

Additional Costs:

Employer Contributions: Include any employer contributions to benefits like health insurance, retirement plans, and more.

Worker's Compensation Insurance: Account for the cost of worker's compensation insurance, which provides coverage in case of work-related injuries or illnesses.

Administrative Costs: Consider administrative costs related to payroll processing, HR management, and other administrative functions.

Total Employee Cost: Sum up all the components mentioned above to calculate the total cost of employing the individual.

FTE Calculator

Calculate FTE using BeforeSunset’s FTE calculator. Download it for free by clicking the cover image. Try BeforeSunset AI today!