This comprehensive guide explores accrued revenue in the context of SaaS businesses, covering its fundamental concepts, importance for financial reporting, and practical implementation strategies. Through real-world examples and expert insights, readers will learn how to properly manage and record accrued revenue while avoiding common pitfalls that can impact their business's financial health.

Imagine this: You've just closed a fantastic deal – a year-long subscription with a high-value client. The contract is signed, your team is celebrating, but there's one catch – the cash isn't in your account yet. This common scenario in the SaaS world introduces us to a crucial concept: accrued revenue.

For many SaaS businesses, understanding accrued revenue isn't just about keeping the books straight – it's about gaining a clear picture of your company's financial health and making informed decisions about its future. Whether you're seeking funding, planning for growth, or simply trying to maintain accurate financial records, mastering accrued revenue is essential.

In this guide, we'll break down everything you need to know about accrued revenue in the SaaS context, providing you with practical insights and actionable strategies to manage it effectively.

What is Accrued Revenue in the Context of SaaS?

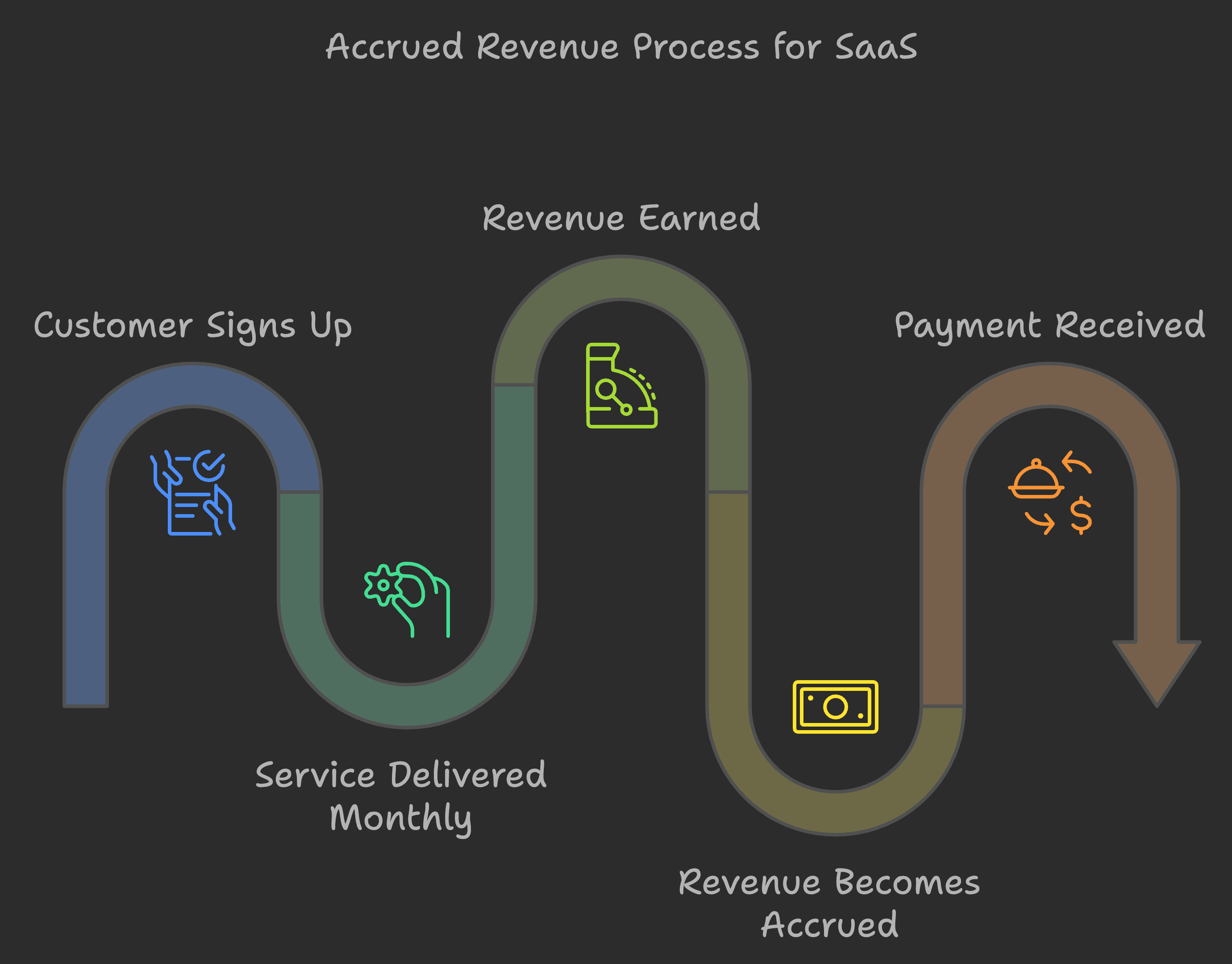

Accrued revenue is money you've earned but haven't received yet. In the SaaS world, this concept takes on particular importance due to the subscription-based nature of the business model.

Let's break it down with some real-world examples:

Example 1: Monthly Billing

A customer signs up for your premium plan at $1,200 per year, billed monthly. Each month, you earn $100 in revenue when you deliver the service, regardless of when the customer actually pays their bill. This $100 becomes accrued revenue until the payment is received.

Example 2: Annual Prepayment

A customer prepays $1,200 for an annual subscription. This isn't accrued revenue – it's actually deferred revenue. Each month, $100 moves from deferred to earned revenue as you deliver the service.

The key distinction? Accrued revenue is earned but not yet received, while deferred revenue is received but not yet earned.

Pro Tip: Create a visual timeline for each subscription type, marking when revenue is earned versus when payment is expected. This helps track accrued revenue more effectively.

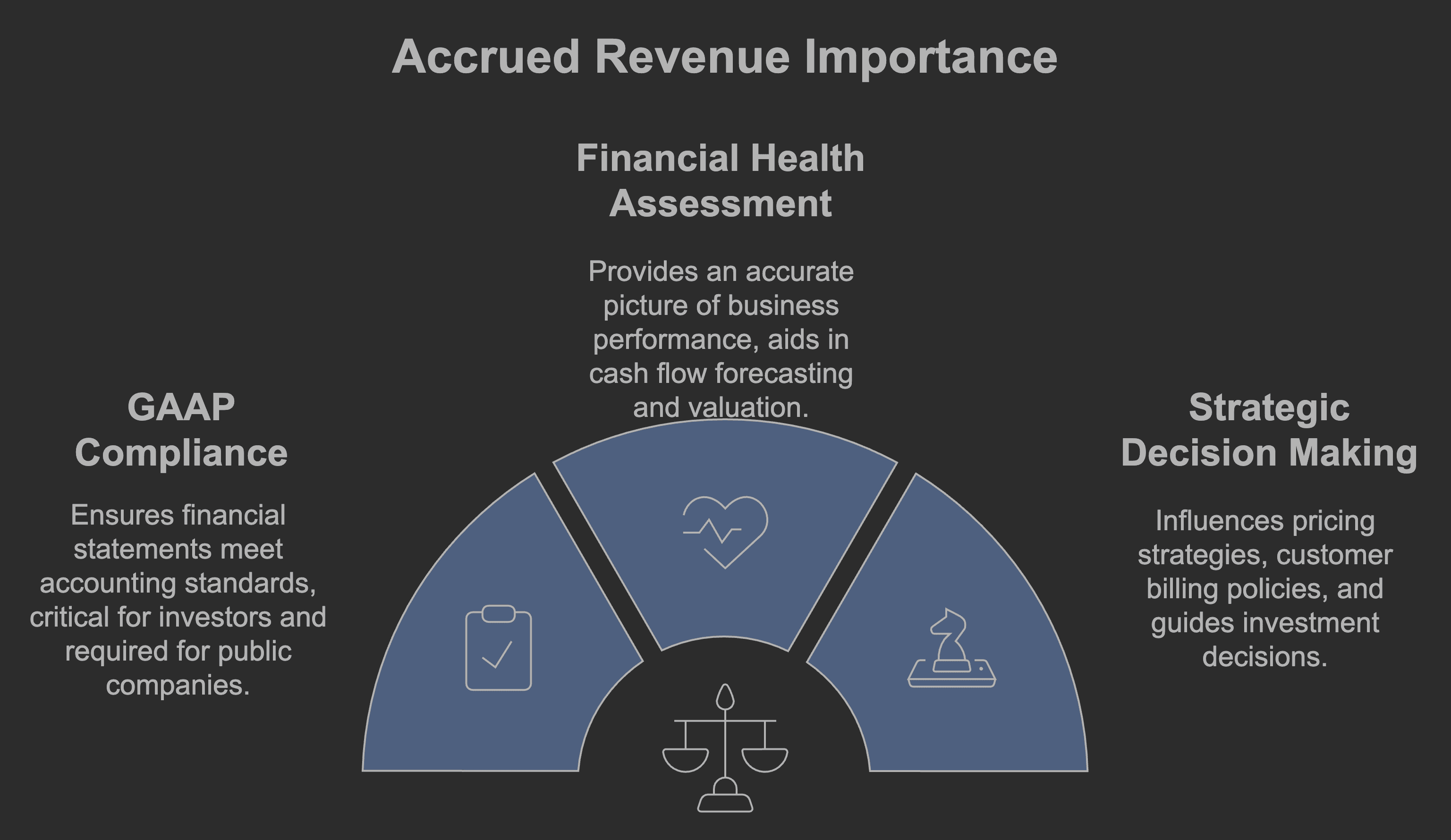

Why is Accrued Revenue Important for Your SaaS Business?

Understanding and properly managing accrued revenue is crucial for several reasons:

GAAP Compliance

Ensures your financial statements meet accounting standards

Critical for potential investors or acquirers

Required for public companies and many private ones

Financial Health Assessment

Provides a more accurate picture of your business performance

Helps in cash flow forecasting

Essential for accurate valuation

Strategic Decision Making

Influences pricing strategies

Impacts customer billing policies

Guides investment decisions

According to a recent OpenView Partners study, 76% of SaaS companies that successfully raised Series A funding had proper accrual accounting practices in place, highlighting its importance for growth-stage businesses.

How to Record Accrued Revenue for Your SaaS Subscriptions

Best Practices for Recording:

Use automated subscription billing software

Maintain detailed documentation

Reconcile accounts regularly

Review revenue recognition policies monthly

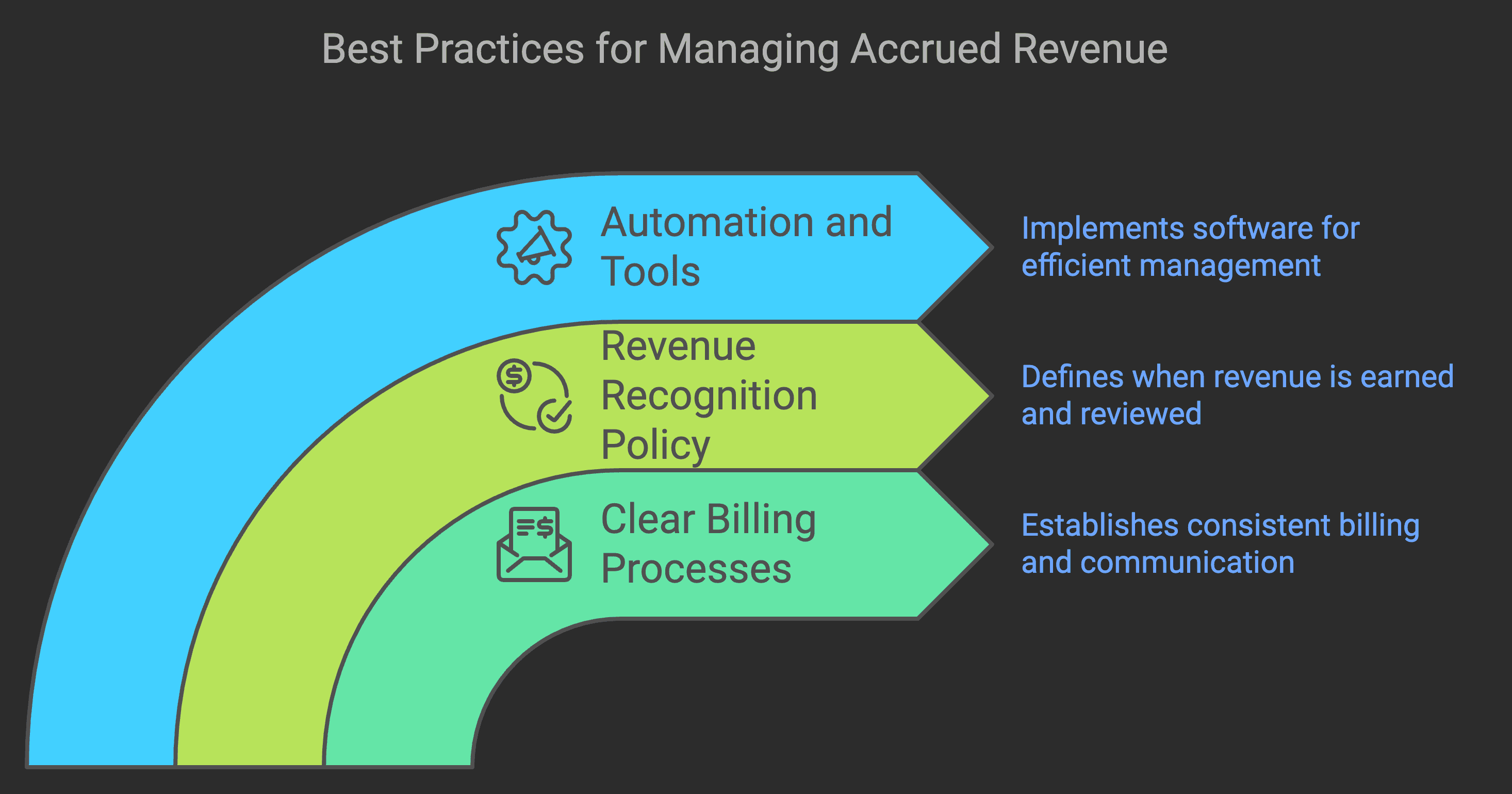

Best Practices for Managing Accrued Revenue in Your SaaS Business

Implementing robust processes for managing accrued revenue is crucial for long-term success:

Clear Billing Processes

Establish consistent billing cycles

Document payment terms clearly

Automate invoice generation

Set up clear communication channels with customers

Revenue Recognition Policy

Define when revenue is considered earned

Document exceptions and special cases

Regular review and updates

Align with industry standards

Automation and Tools

Implement subscription management software

Use integrated accounting systems

Set up automatic reconciliation

Regular backup and audit trails

As Sarah Thompson, CFO of a leading SaaS platform, notes: "A well-defined revenue recognition policy isn't just about compliance – it's about building a foundation for scalable growth and maintaining investor confidence."

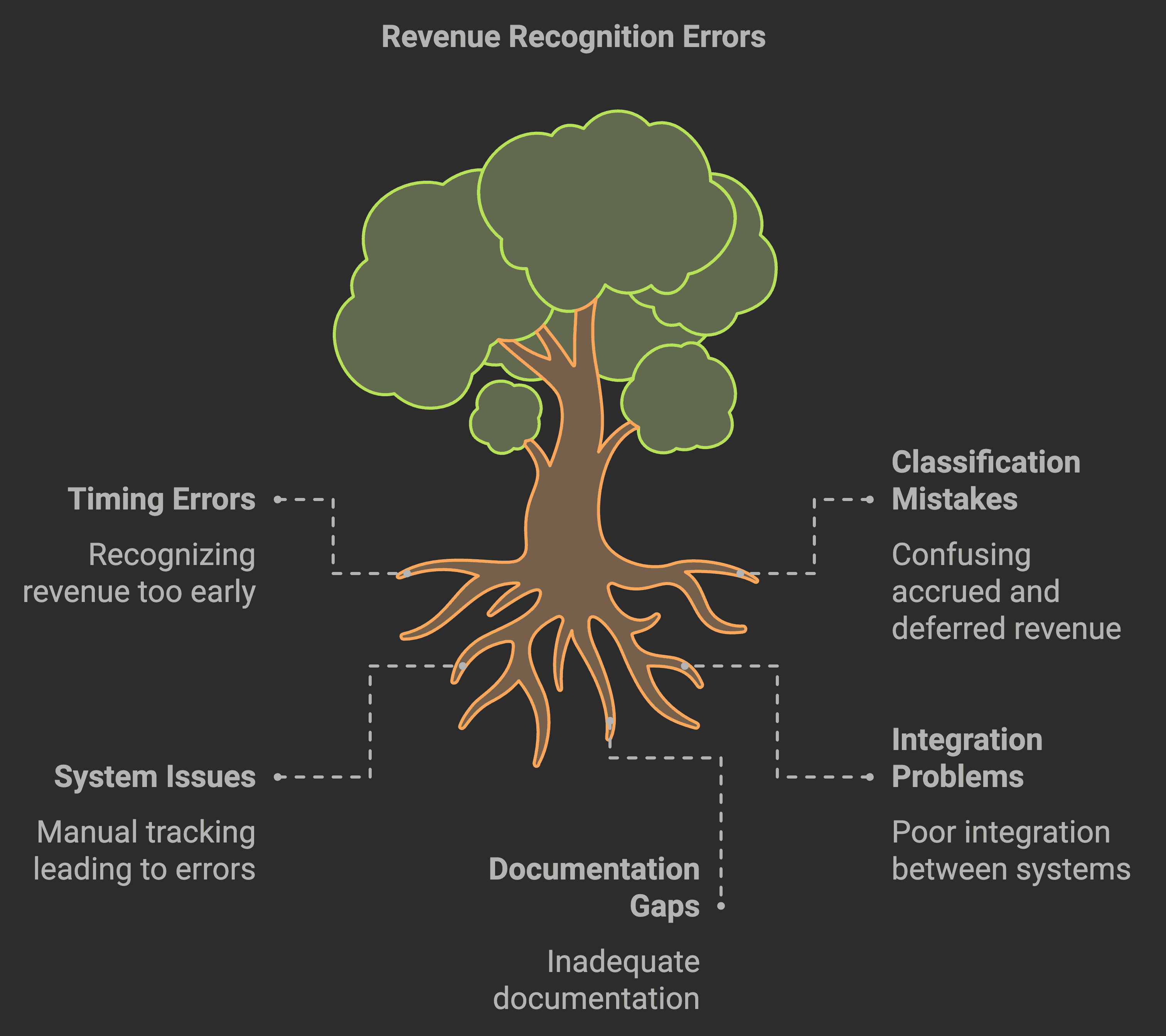

Common Mistakes to Avoid with Accrued Revenue

Watch out for these frequent pitfalls:

1. Recognition Timing Errors

Recognizing revenue too early

Failing to match revenue with service delivery

Inconsistent recognition patterns

2. Classification Mistakes

Confusing accrued and deferred revenue

Mixing cash and accrual accounting

Incorrect journal entries

3. System and Process Issues

Poor integration between systems

Inadequate documentation

Real-World Example: A fast-growing SaaS startup nearly lost a crucial funding round because they had been recognizing annual subscription revenue immediately upon payment, rather than spreading it over the service period. This made their financials appear artificially inflated and required significant restatement.

Conclusion

Mastering accrued revenue management is crucial for any SaaS business aiming for sustainable growth and financial stability. By understanding the concepts, implementing proper processes, and avoiding common pitfalls, you can ensure your financial reporting accurately reflects your business's performance.

Related Article